Changing Tides

So far in 2024, markets have produced significant performance driven mostly by a handful of AI-related stocks. It seems that markets are getting ahead of themselves as the AI technology craze begins to settle down and as we start seeing less-than-favorable economic data points. Still, most companies had positive earnings surprises in the 2nd quarter, however, the uptick in market volatility and recent declines from all-time highs have made investors more nervous.

Recent Economic Data:

Mixed economic data over the past year has become more bearish. July’s non-farm payroll figures were significantly below market consensus (114,000 vs. 185,000 expected), and the July ISM manufacturing PMI came in at a weak 46.8, below the 50-mark needed to indicate growth in the manufacturing sector.

Although the inverted yield curve has not been as reliable a recession indicator as in the past, we've seen the 10-year minus 2-year treasury spread compress significantly, moving from -1.05% at the beginning of last month to around -0.09% now. Typically, a quick reversion back to an upward-sloping curve precedes a recession much like in the chart below. However, we cannot take this as Gospel, especially with more active government intervention to mitigate and shorten recessions.

Federal Reserve and Interest Rates:

The Federal Reserve is expected to initiate rate cuts in the foreseeable future, with markets projecting three cuts by the end of this year and four cuts in 2025. The Bank of England has already cut rates by 0.25%, while the United States has continued to hold off. Importantly, short-term rates have already priced in the projected rate cuts for 2024, suggesting the Fed may need to play catch-up.

One major caveat to The Federal Reserve cutting rates next month is trepidation around the “Japanese Yen Carry Trade” that could potentially get unwound if / when the United States starts to cut rates. The carry trade has been an investment strategy to borrow from Japan, which has had historically low rates, and reinvest that money in higher-yielding investments such as U.S. treasuries, equities, etc. The Bank of Japan has recently been hiking rates, which has caused their currency to increase against the U.S. dollar and thus erode the performance of this type of trade, causing mass broad market selloffs in potentially billions of dollars currently involved. However long-term trends suggest yields may go lower as the economy softens with some potential bumps on the way down.

Market Performance:

As mentioned, only a few stocks have driven most of this year's equity market performance. This lack of market breadth can be a double-edged sword, providing outsized returns when the market is up but also significant losses on the downside. The recent downturn has shown mixed results for the magnificent seven stocks, which may trend lower compared to the indices if the market correction continues.

*Figures as of close 8/8/2024

AI Hype and Comparisons to the Dotcom Bubble:

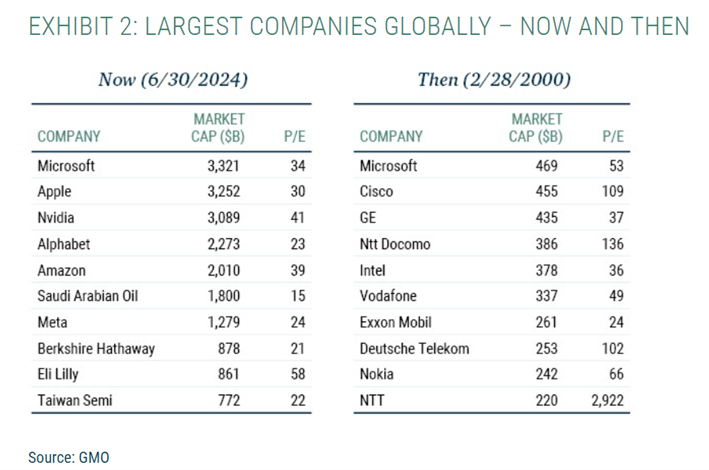

Concerns about a 2000 Dotcom-type bubble due to the AI hype are popping up more in the news. While current valuations are elevated, there is great potential in AI technology to increase revenue margins as companies automate more things in the workplace. A healthy correction might be in order, but to say we’re currently as exuberant as during the Dotcom bubble seems extreme. To put it into perspective the 10th largest company in the year 2000 had a P/E ratio of 2,922 shown in the table below with many others having triple-digit P/Es, something not seen today.

Alternative Investments:

Investments in private credit continue to provide a strong income profile with low relative volatility. Private equity had a challenging year in 2023 but has seen a rebound in valuations this year. Exits have also increased this year. Outside commercial properties, by and large real estate has held up even in the current prolonged higher-rate environment. Gold continues to perform well as many central banks continue to increase their reserves.

Final Words:

Increased volatility is likely to remain a consistent theme in the coming months, which for many investors is uncomfortable. However, maintaining a well-diversified and thoughtful investment strategy has proven time and again to lead to consistent results through times of increased volatility. As we close out the summer, the upcoming election cycle, evolving economic data, and Fed Policy and corporate earnings remain at the forefront of investor concerns.

Please don’t hesitate to reach out directly with questions or concerns. Thanks for taking a look!

|

Josh L. Galatzan, CIMA® |

Kirk Price |

|

Chris J. Popso |

Brian J. Noonan, CEPA |

|

Meagan Moll, CIMA®, CFP®, CPWA® |

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.