2020: A Year Divided

2020: A Year Divided

January 26th, 2021

As we sit down to write our annual commentary, we recognize that in a year like 2021 a commentary on where we have been and where we are going is challenging, to say the least. Whatever our outlook may be today, there will be unexpected surprises, as there were in 2020. A year ago, no one could have predicted COVID-19’s massive impact, a political environment so divided, the lockdowns, the protests, the wildfires, the food shortage, the job losses. We all had a hard year. But as we look back on one of the most unprecedented years any of us has lived through, we can take comfort in history. There are similarities and lessons that we can apply to our expectations for the future, and actions we can take to protect and grow in our personal lives, and in our portfolios.

A Year of Extremes

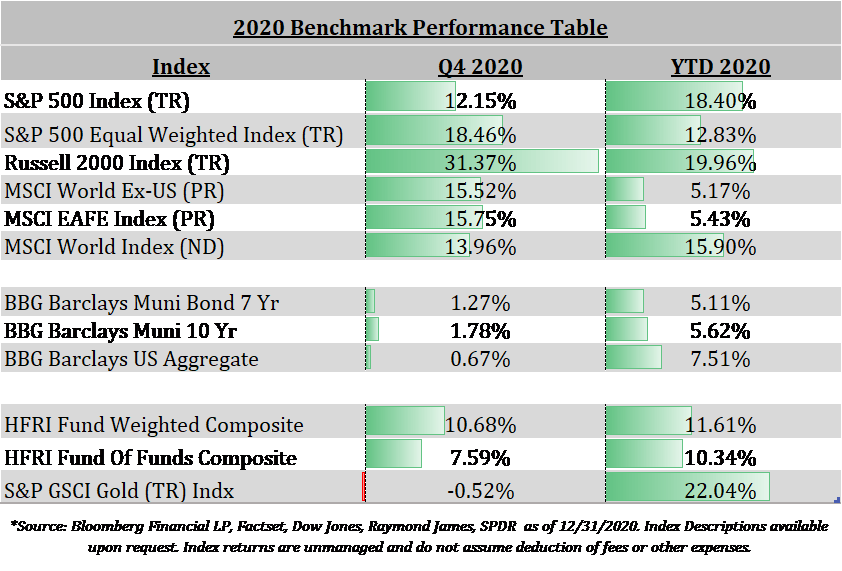

Despite 2020’s unexpected events and subsequent recession, the stock market recovered in dramatic fashion. After 128 months of economic expansion, the market drawdown started in February with concerns around US-China tensions and recovered by August, marking one of shortest bear markets and on paper, despite its severity. The rapid decline in the stock market and V-shaped recovery was astonishing.

The statistics below highlight some of the extremes we experienced last year in the economy and financial markets:

- The S&P 500 had more than 40 swings of 2% or more.

- 2020 had the most volatile days of any year on record, as measured by points low to high during the day.

- By November 24th, we had a new high on the Dow at 30,000, and by January 7th, 2021 we had reached yet another new high of 31,000.

- US Household savings increased over $1 trillion, an increase of over 10%, creating a serious tailwind going into 2021.

- Unemployment rates went from 3.5% in February to 14.8% in April. Fortunately, that decreased to 6.5% but we still have almost 20 million Americans unemployed or underemployed; 4 million of which have been jobless for at least six months.

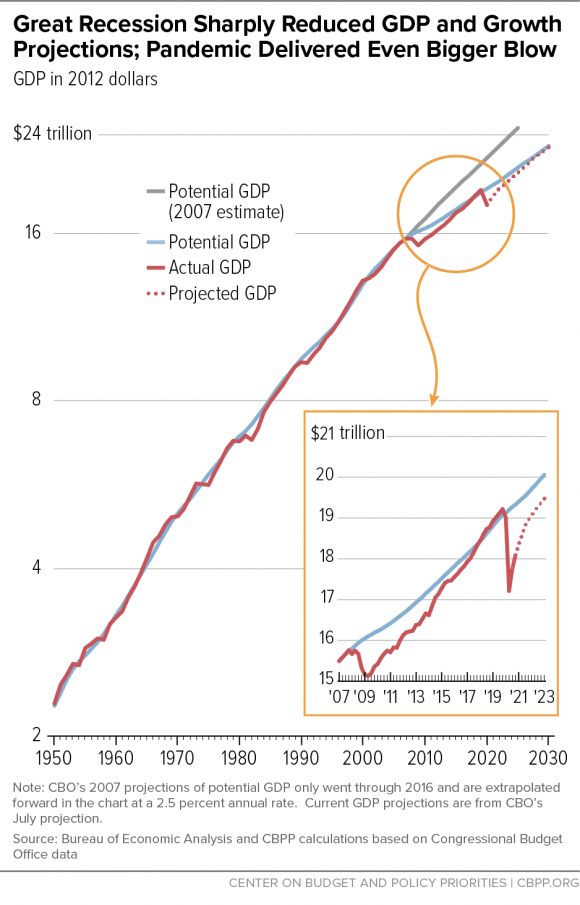

- The US Deficit has tripled, and GDP has declined by 2.3%, or $500.6 billion.

Government Response

In 2020, we also had a significant amount of domestic political division. As we noted in 2019, most election years have positive equity returns. Despite the impact of COVID, that trend continued. Rather than replay the hotly divisive topics that raged throughout the year, we will examine the government response: first at the unprecedented level of monetary and fiscal stimulus that propped up the economy and then the Biden administration and the potential effect of their policy agenda. Both pieces point to a sustainable recovery.

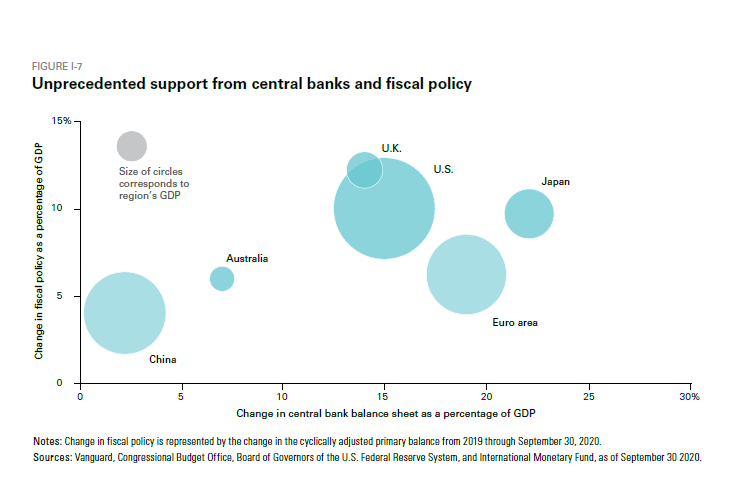

Critical stimulus bills and agency programs created a significant cash inflow through loans and grants that helped many businesses weather the storm, while extremely accommodative monetary policy helped sooth financial markets and stoke the economic recovery. As you can see below, similar support was provided around the world, as central banks rushed to provide money supply to avoid a liquidity crisis like what we experienced during 2008.

Source:Vanguard economic and market outlook for 2021: Approaching the dawn, December 2020

The Federal Reserve acted more quickly and aggressively than their counterparts. They expanded the emergency loans to a 90-day loan (from overnight) and created a first-ever facility to buy corporate debt, providing desperately needed liquidity in the investment grade corporate bond market. It certainly worked, as the response marks the low in the bond and stock markets for the year. While this stance certainly contributed to the abnormally low interest rates we have today, the yield curve looks normal, albeit extremely low.

The Fed is rightfully concerned about unemployment and the general health of the economy. There is a critical balance of debt to GDP. With the Pandemic approaching a year old, the federal deficit has tripled, unemployment remains uncertain, and the Fed is still concerned that inflation could emerge. Powell has indicated a generous money supply with a target rate of zero for three years, or until the inflation rate rises above 2% for some time. This leaves room for some period of outsized inflation, something we haven’t seen for over a decade.

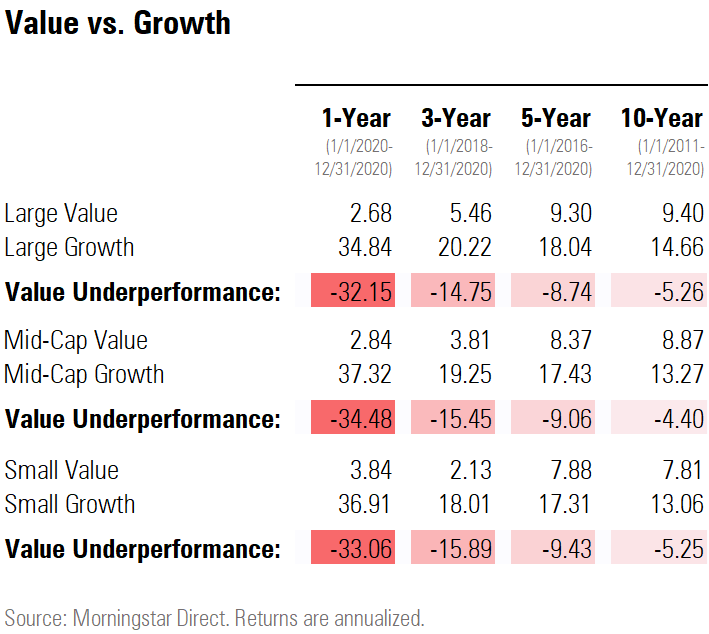

COVID affected stocks

Before March, value had been underperforming growth stocks on a relative basis for some time. The recovery from the COVID lows disproportionally benefited growth stocks. The pandemic has certainly delayed recoveries that are overdue and may have changed the dynamics of many technology stocks permanently.

While we hear constantly that a correction is due for technology, we have to ask ourselves – Has Covid-19 permanently changed the field? Fundamentally, there has been a significant shift in adoption. Even the least tech savvy people learned to zoom, turn on their video and mic, and Facetime their friends. Businesses learned that their employees could work from home as their continuity plans were tested. Some tech companies went so far as to say their workforces would not return to traditional brick and mortar buildings.

2021 Outlook

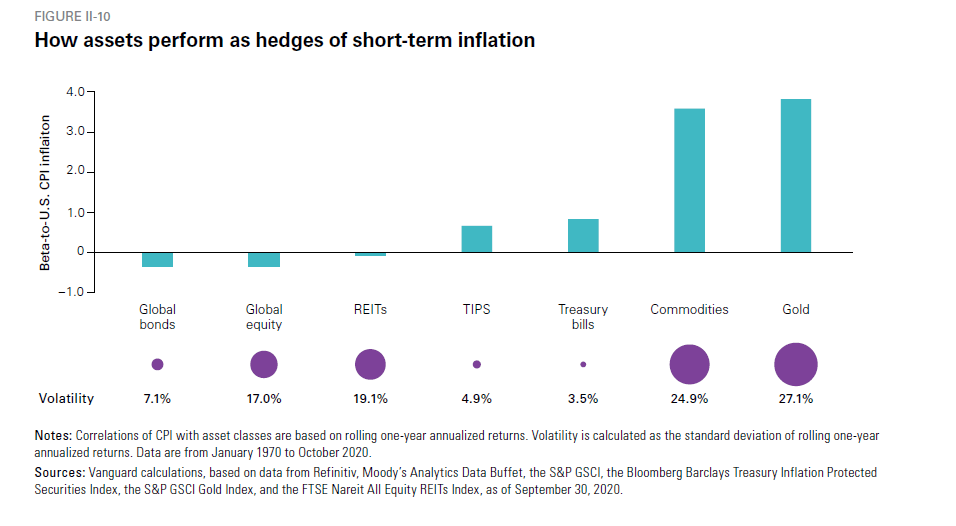

The potential “return to normal” scenario could provide a quick release of the household savings built up during the last nine months, driving up equity returns and possibly triggering an inflationary shock. If we do enter an inflationary environment, we have a portion of the portfolio allocated to address those concerns, including the alternative allocation. Equity values are supported by falling real rates, even though they negatively impact existing fixed income. Yield and income will continue to be challenging in this environment, though we do not seek to decrease quality to chase it.

Within fixed income, current return expectations are not compelling for fresh capital, though we remain committed to our existing exposure. We will continue to focus primarily on high-quality and short duration in our allocations.

Typically, as we enter a reflationary environment, we expect value, small capitalization and international equities to outperform. This is exactly what we saw in the fourth quarter, with small and international indices recovering quickly the last few months. The Russell 2000 Index enjoyed the best quarter in its history (+31.4%) with emerging markets, international developed and mid cap close behind.

Within the equity allocation, valuations appear stretched. However, when one considers the current monetary policy backdrop coupled with the anticipated re-acceleration in economic growth and company earnings, valuations appear much more reasonable. If we can get a substantial portion of the population vaccinated in a reasonable amount of time, we may see a return to work, schools, hotels and restaurants by the end of the year. We have seen a proven correlation between spending and children returning to school, so we feel confident that the average household spending will increase, but the magnitude of that force remains to be seen. Earnings growth will be critical to continued growth, particularly in Industrials, Financials, Materials and Consumer Discretionary.

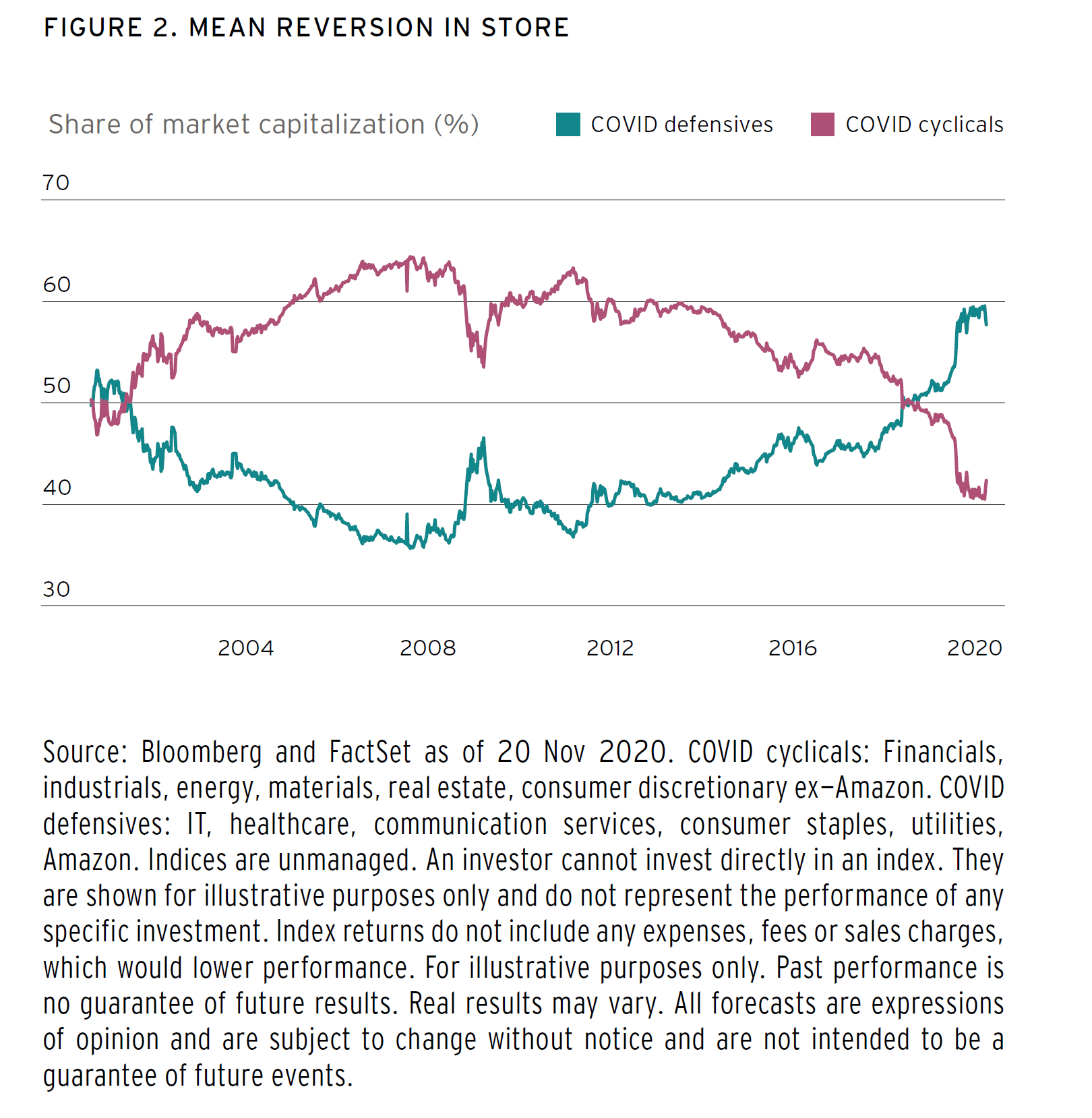

We believe COVID cyclicals such as hospitality and energy have the potential to surge post-vaccine. One could argue that a mean reversion exists in value only, and prices on technology will remain high as we learn to work differently, delivering solid absolute returns. The chart below shows an interesting analysis. If you divide the sectors into COVID defensive and COVID cyclical, and move Amazon from consumer discretionary to COVID defensive, we see a pattern emerge.

Source: Citi Private Bank, Finding Opportunities - Investing for a post-COVID World, 2021

Tax Policy

As we usher in a new administration, the biggest item on many minds is tax policy. President Biden’s proposed policy certainly outlines some dramatic moves. Among them are an elimination of the reduced capital gain for those with income over $1 million, an increase to corporate tax rates, and an increase to the top tax bracket from 37% to 39%. That being said, the corporate tax rate would not be as high as it was before the Tax Cuts and Jobs Act and politicians on both sides of the aisle would have reason to be cautious about a tax increase at this stage of the economic cycle. Whatever the final tax proposal is, it will have to appeal to a bipartisan Congress. There is a razor thin majority so it will need full Democratic support to pass. If even one Democratic candidate is concerned about a tax increase for constituents, and the Republicans stand firm, the new policy would not pass.

Biden has promised tax increases will not apply to those who earn less than $400,000 a year and we expect a few possible credits and deductions as part his plan: an increased child credit, an increased childcare deduction, and possibly a new health insurance tax credit. Many of the president’s appointees are Washington veterans, suggesting a more moderate approach as he navigates his first 100 days; Yellen as Treasury Secretary is an important signal. During the presidential debates and since, Biden has been talking about one of the most powerful governmental mechanisms for economic expansion: infrastructure spending. Spending money on infrastructure is an incredible tool to positively impact unemployment, raise low to middle income family income, increase GDP, and prepare the economy for the next decade.

In 2021, the pandemic and policy will continue to heavily influence the economy and financial markets, but we remain focused on fundamentals: demand, company earnings, and revenue growth. Risk assets have anticipated a return to normal; whether 2021 can deliver that remains to be seen. We will lean heavily on our diversification toolbox, as it has always served us well. 2020 proved that to us in a way few could expect. We wish for your health and safety in 2021 and thank you for your continued confidence and support.

Sincerely,

Meagan K. Moll, CFP®, CIMA®, CPWA®

Partner & Wealth Advisor

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Brian J. Noonan, CEPA

Managing Partner

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.