Opportunity Zones: Merging Impact Investing & Tax Efficiency

Opportunity Zones: Merging Impact Investing & Tax Efficiency

October 30th, 2019

The Tax Cuts and Jobs Act of 2017 ushered in several changes to the US Tax Code. While much of the headline focus centered on corporate tax cuts and individual income tax cuts, one of the more interesting and potentially impactful aspect was the Qualified Opportunity Zone Program (“QZOP Program”).

The Qualified Opportunity Zone Program was designed to incentivize private sector investments in designated economically distressed communities by providing significant tax incentives to investors via investment vehicles know as Qualified Opportunity Zones. QOZs have quickly gained traction with a broad array of investors and have created a window of opportunity for impact minded and tax conscious investors alike.

What is a Qualified Opportunity Zone?

- QOZs are designated census tracts throughout the United States and Puerto Rico that have been selected by state governors for inclusion in the program. 35 million people reside in rural and urban Opportunity Zones.

- QOZ’s are an economic development tool, designed to spur economic growth and job creation, reduce unemployment and poverty rates, as well as increase the median income, home ownership and access to affordable housing.

- Recent data reflects:

- The average designated Opportunity Zone has a median family income of $44,700 (compared to the national median income of $70,900).

- The average designated Opportunity Zone has a minority population share of 56.3% (compared to the national average of 38.5%).

- The average designated Opportunity Zone has a poverty rate of 28.9% (compared to the national average of 14.6%).

- The average population growth in designated Opportunity Zones was just 0.9% from 2006-2010 to 2013-2017 (compared to the national average of 5.6% during the same time period).

*Source: Economic Innovation Group (EIG), https://eig.org/opportunityzones/facts-and-figures; https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions

What are Opportunity Zone Funds?

- Qualified Opportunity Zone Funds are designed to allow investors to invest in designated Opportunity Zones while taking advantage of certain federal capital gains tax benefits.

- QOZFs must meet a stringent set of criteria, including investing 90% of their capital in QOZs, and must be certified by the US Treasury.

- QOZFs focus in infrastructure, real estate and clean energy. Real Estate investments are subject to a substantial improvement provision under which the property must be substantially improved within the 31-month period following acquisition. The improvements must exceed the purchase price of the property, excluding the land value.

- QZOFs come in many shapes and sizes. Sponsors range from large multinational investment banks to large private equity firms and small locally focused impact investment-oriented groups.

What are some of the risks around Opportunity Zone Investing?

- As is the case with all investments, do not let the tax tail wag the investment dog. One should underwrite the merit of the investment on a stand-alone basis, then evaluate any tax benefits that may be present. One should understand the risk associated and how the investment fits within a well-constructed, diversified portfolio.

- QOZFs are not designed to be liquid investments. Liquidity needs should always be considered before making investments in illiquid strategies.

- Maintaining compliance of all Opportunity Zones regulations. Failure to do so could jeopardize the intended tax benefits.

- A potential supply shock occurring in 10 years. Due to the Opportunity Zone regulations, the opportunity investment would receive a tax-free capital gain status if the investment is held for 10 years or more. As such, there may be several opportunity zone investments in liquidation mode at roughly the same time. Thus, flexibility in fund documents around the timing of the exit is important.

What are the potential tax benefits to investors?

Investors in Qualified Opportunity Zone Funds have three potential tax benefits:

- A temporary tax deferral: Individuals or Corporations with capital gains realized through the sale of an investment asset can defer the tax liability associated with their capital gain until 2027 if the gain is reinvested within 180 days into a Qualified Opportunity Zone Fund. The investor may elect to invest the entirety or a portion of their capital gain into a QOZF. The gain must be recognized on the earlier of the date on which the Opportunity Zone Fund is sold or December 31st, 2026.

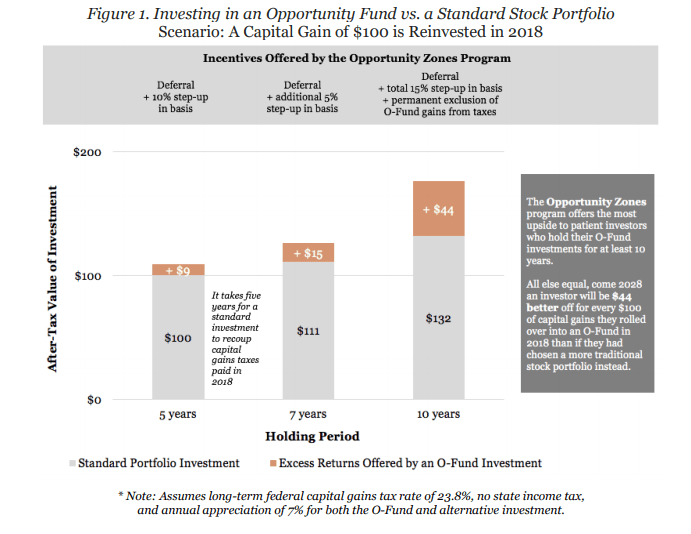

- A step-up in cost basis: For capital gains invested in qualified Opportunity Zone Funds, the basis of the original investment is increased by 10% if the investment in the qualified opportunity zone fund is held by the taxpayer for at least 5 years, and by an additional 5% if held for at least 7 years, excluding up to 15% of the original gain from taxation.

- A permanent exclusion of capital gains: Investors pay no capital gains tax on new gains generated by Qualified Opportunity Zone Funds if held for more than 10 years. This exclusion applies only to the gain realized through the sale or exchange of the QOZF, not the original investment.

Below is an illustration of the potential economic impact resulting from the tax benefits associated with Qualified Opportunity Zone Fund investments.

*Source: Economic Innovation Group (EIG); www.eig.org

Qualified Opportunity Zones have created an opportunity for impact-minded investors to defer capital gain tax liability and redeploy capital that could meaningfully impact economic development and quality of life in those areas. At the same time, the program has created a significant tax planning strategy for investors with meaningful capital gains. While this section of the tax code has been widely discussed amongst investment and tax professionals, many investors are still not aware of the multi-faceted benefits of QOZP. If you have realized significant capital gains in the last 180 days or are anticipating doing so in the near future, consider reaching out to our team and / or your tax advisor to learn more about Opportunity Zones.

Below we have included links to a couple of great resources on Qualified Opportunity Zones:

- https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions#investor

- https://eig.org/opportunityzones

Please do not hesitate to reach out directly to discuss any of the enclosed information in more detail.

Thanks for taking a look!

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Brian J. Noonan, CEPA

Managing Partner

Meagan K. Moll, CFP®, CIMA®, CPWA®

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.