Q1 2019 Commentary

Q1 2019 Commentary: A Strong Reversal

April 15th, 2019

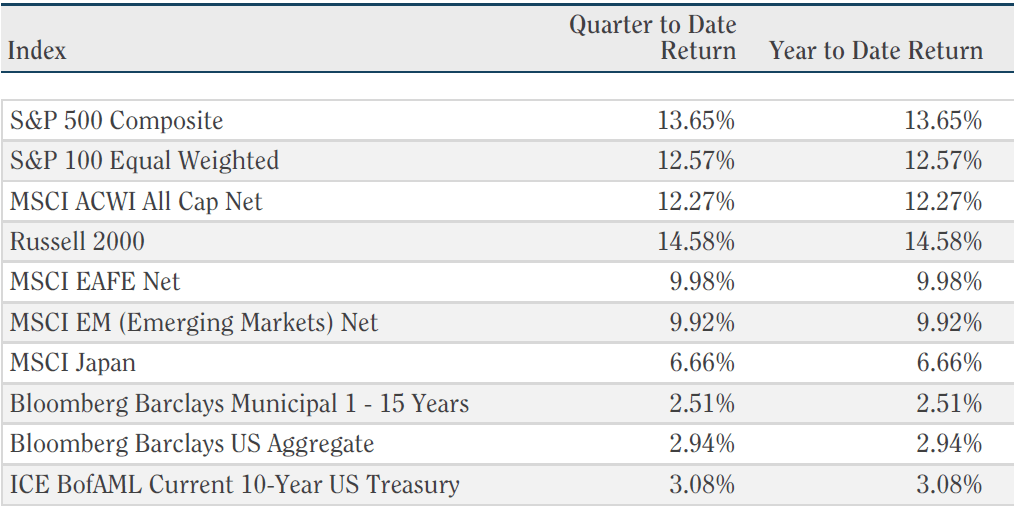

Coming off the worst their worst quarter since 2011, global equities staged a strong reversal to the upside in the first quarter. Buoyed by optimism around the US-China trade dispute, softer commentary from the Federal Reserve and easier monetary policy in Europe the S&P 500 delivered a nearly 14% return in the first quarter, while developed international and emerging market equites rose nearly 10%.

Fixed income indexes rallied as well, as we saw the 10-year Treasury yield sink to a low of 2.41% during the quarter (more on that later). The Barclay’s US Aggregate Index rose 2.94% while the Barclay’s Municipal 1-15 Year index rose 2.51%.

The fourth quarter of 2018 was dominated by a handful of headlines that lead to a swift and substantial decline in risk assets. As we noted in our 2018 review:

“Increased focus on trade tensions between the US and China, a flattening yield curve leading to increased fears of a global economic slowdown and possible recession in the US, tightening financial conditions and geo-political concerns surrounding Brexit, government shutdowns and the Mueller investigation came together to drive the most negative December on record and the worst year for equity returns since 2008. International markets delivered even more disappointing returns than domestic markets, exacerbated by a strong rally in the dollar relative to nearly every major currency in the world.”

The first quarter of 2019 proved to be virtually the polar opposite of Q4 2018. Fears that the Fed would move too quickly to tighten monetary conditions shifted to expectations that we may actually see rate cuts in 2019; worries of an impending recession transitioned to the belief that the slowdown would be temporary in nature and hopes that a favorable, if not sweeping, resolution to the US-China trade dispute will soon emerge replaced fears that the negative implications of the trade wars would linger on throughout the year. Additionally, the end of the longest government shutdown in US history provided investors with relief. Interestingly, global markets were able to deliver decidedly positive results despite persistent political tensions and the complete failure of Brexit negotiations in the UK.

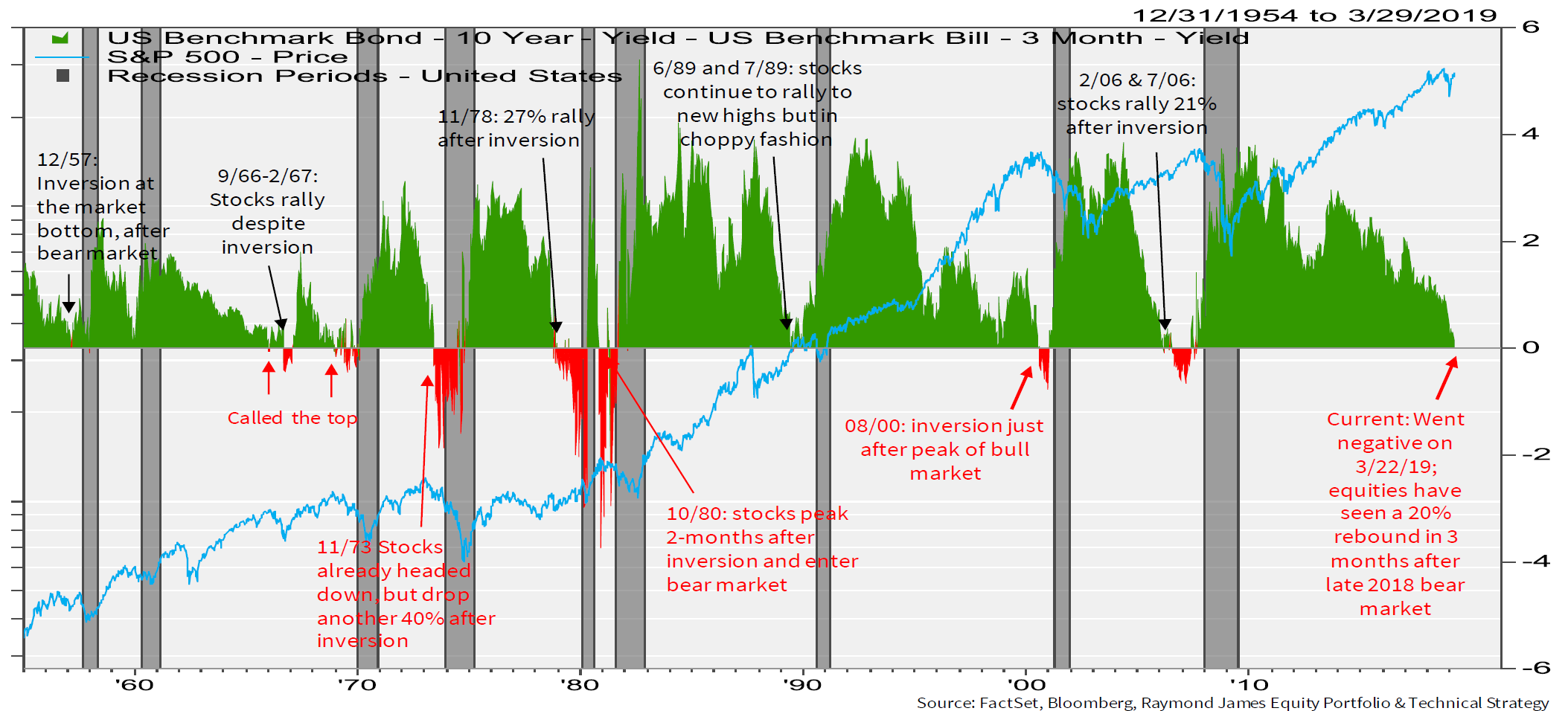

Signs of the economy slowing (?): We were inverted…

While the market seems to have shrugged off mixed data and concerns over the economy slowing in the first quarter, we did see several data points that point to a potential slow down. The most often sighted data point was the briefly inverted yield curve (3-month Treasury to Ten Year Treasury spread) that immediately followed the Fed’s more dovish commentary. As a reminder, an inverted yield curve (when short term interest rates are higher than longer term interest rates) has been an extremely consistent predictor of past recessions. As we have often noted in recent commentaries, this is an indicator that we follow closely. We have also noted that while an accurate indicator, inversion often pre-dates recession by as much as two years. The brevity of the recent inversion also leaves the door open to the possibility that the yield curve may have given a false signal in this instance. In any case, we feel that this is an important indicator that, when coupled with other data points, could be pointing towards a possible slowdown.

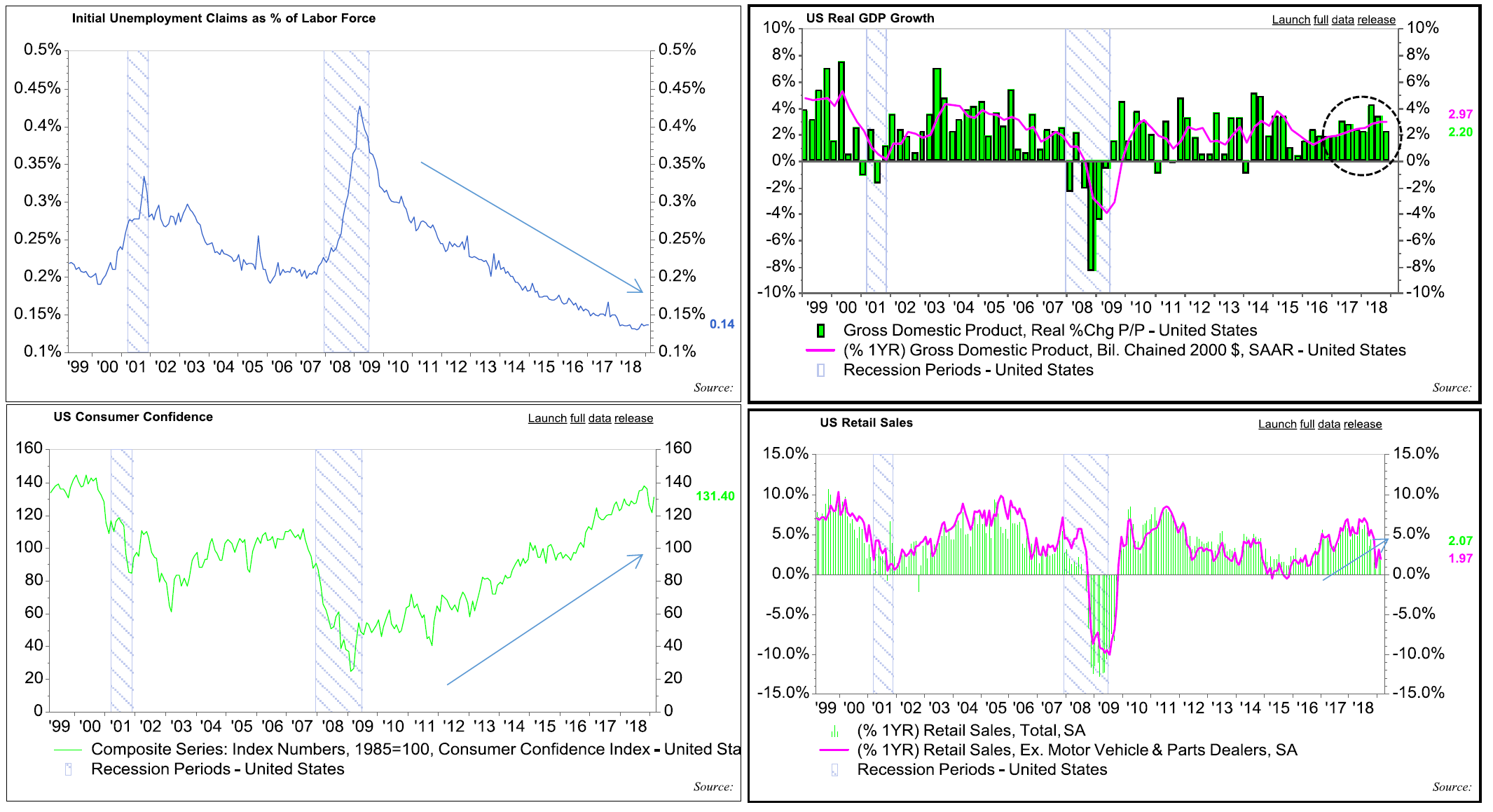

The inverted yield curve was not the only concerning indicator during Q1. Fourth quarter GDP was revised down from 2.9% to 2.2%, while the economy added only 20,000 jobs in February. Retail sales came in weaker than expected in February, the third month in a row of sub-3% growth. Housing data remains soft, with starts and permits both in decline. Finally, Crude Oil rallied nearly 30% in the first quarter, which could put a strain on the consumer if prices continue to move higher for an extended period.

On the positive side, the unemployment rate dropped to 3.8% while wages grew 3.4%. Housing did see a sharp increase in existing home sales as mortgage rates dropped nationwide. Inflation remains below the Fed’s target of 2%, easing the Fed’s decision to halt rate hikes and slow down their balance sheet run-off.

Overall, we would characterize the current economic backdrop as softer than previous quarters, but generally supportive, and not indicative of an imminent recession.

It is important to note that the economy is never “due for a recession” and predicting them is very difficult. This is partly because we have a relatively small sample size, with only three since 1980. It is also important to note that one quarter of negative GDP growth does not constitute a recession. Recessions are determined by the National Bureau of Economic Research (NBER) and is defined as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in GDP, real income, industrial production and wholesale-retail sales”. In other words, a recession begins when the level of economic activity peaks and starts to decline, and it ends when the economy begins to grow again. The next recession is inevitable, but we find the likelihood of recession in this calendar year as relatively low. For some analysis on the relationship between recessions and bear markets, please revisit our commentary from November of 2018.

Valuations: Fair Enough

In January we characterized US equity valuations as a potential tailwind for stock prices:

“higher earnings and lower prices have pushed S&P 500 valuations to what we view as very reasonable levels (14.4x expected earnings). Again, this is by no means excessively inexpensive, but is in fact slightly below the fifteen-year average and well below the five-year average. Consensus estimates are calling for approximately 6% growth in 2019, and while estimates can and will be revised, we view these estimates as plausible. Fundamentally, there is no reason that the markets cannot move higher in 2019…”

While we were correct on this observation, we by no means expected such a drastic recovery in one quarter alone. With the market’s sharp rally in Q1, valuations have moved to a much more neutral reading. After troughing at 14.7x earnings in December, the S&P 500 price to earnings ratio expanded to 17.2x at quarter’s end. While still below the 5-year average and well below the 21.8x multiple recorded in January of 2018, we are now 1% above the 15-year average. Equities still have room to move higher, particularly if earnings surprise to the upside, but we continue to believe that significant multiple expansion is unlikely.

Volatility: Another disappearing act

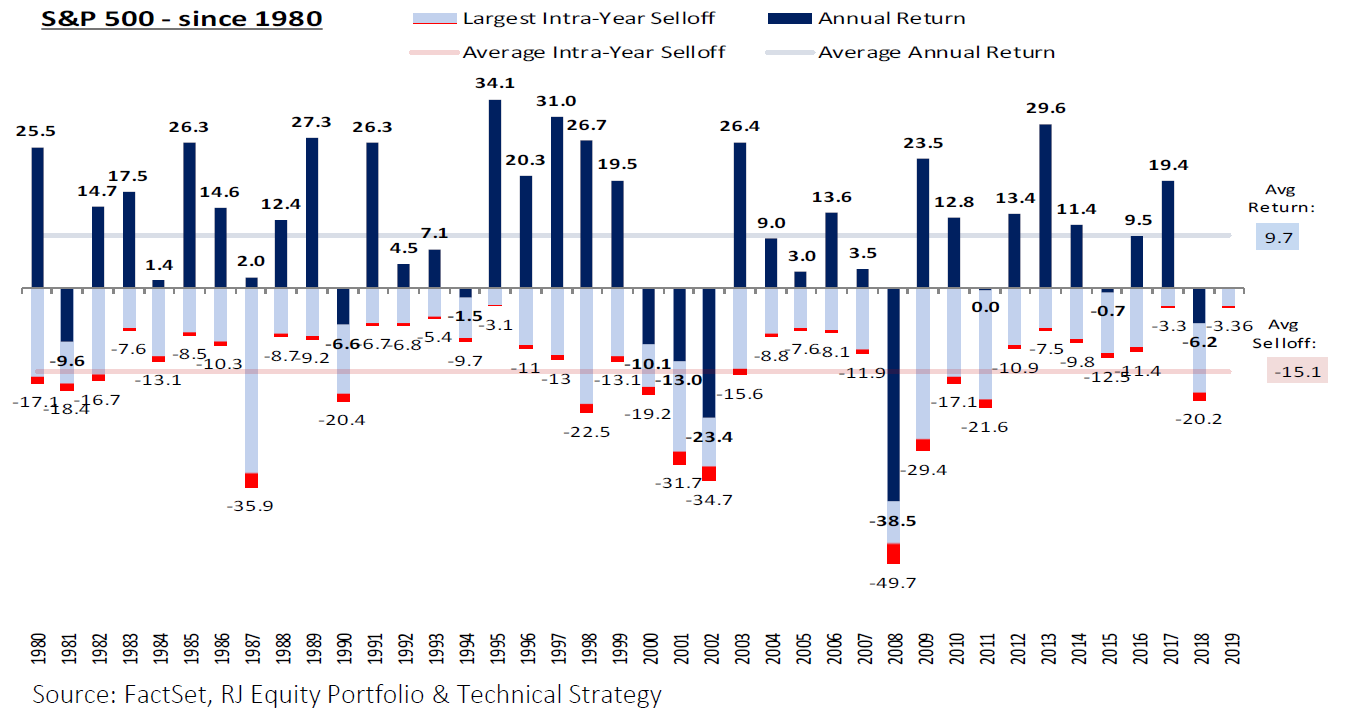

2018, particularly the fourth quarter, was a stark reminder that volatility may dissipate for short periods of time but is an ever-present factor in equity markets. While equities have rallied nearly 20% from their December lows, they have done some with limited volatility. Only 17% of trading days in the first quarter saw moves of more than 1% in equities, with 8 of those 11 moves being to the upside.

Given the current backdrop, we would expect volatility to pick up as the year moves forward. It is most likely that the market will see at least one period of consolidation in the coming months (i.e. a pullback). This would be the norm, as we have mentioned many times in recent years. Since 1980 the average intra-year sell-of is 15.1%, while the average annual rate of return for the S&P 500 is 9.7%.

Summary: Things aren’t perfect, but they’ll do

While first quarter economic readings were mixed at best, equity markets rallied sharply while bond markets also delivered positive results. So far, the second quarter is off to a decent start as well. Non-farm payroll numbers rebounded sharply and last week’s initial jobless claims number came in extremely low while retail sales numbers came in above expectations this week. Inflation appears to remain muted which should allow the Fed to maintain its current accommodative position. The S&P 500 has gained approximately 2.5%, pushing it within 1.5% of its all-time high.

We continue to view protectionism and the US-China trade dispute as the most significant factor in current environment. Momentum in trade negotiations with China appears to be progressing. We believe any positive outcome here will be a tailwind for risk assets and the global economy, while any negative outcome would likely lead to consolidation. The administration has increased its trade rhetoric around Europe in recent weeks, and we can only hope that we do not enter another prolonged trade dispute.

Earnings season has officially kicked off, and so far, the numbers have been positive overall. We continue to believe that an earnings recession is not likely in the next few quarters

While the current environment is by no means perfect, we view the likelihood of imminent recession as low and believe the fundamental backdrop is generally supportive of current valuations. We do, however, recognize that the economy is showing signs of slowing and that we are likely in the later stages of a long-term secular bull market. How long the later stages may last is impossible to determine. For the time being we believe the good outweighs the bad and are positioned accordingly.

Thanks for taking a look!

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Meagan K. Moll, CFP®, CIMA®, CPWA®

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.