Peak Earnings vs. Peak Earnings Growth: An Important Distinction

Peak Earnings vs. Peak Earnings Growth: An Important Distinction

January 21st, 2019

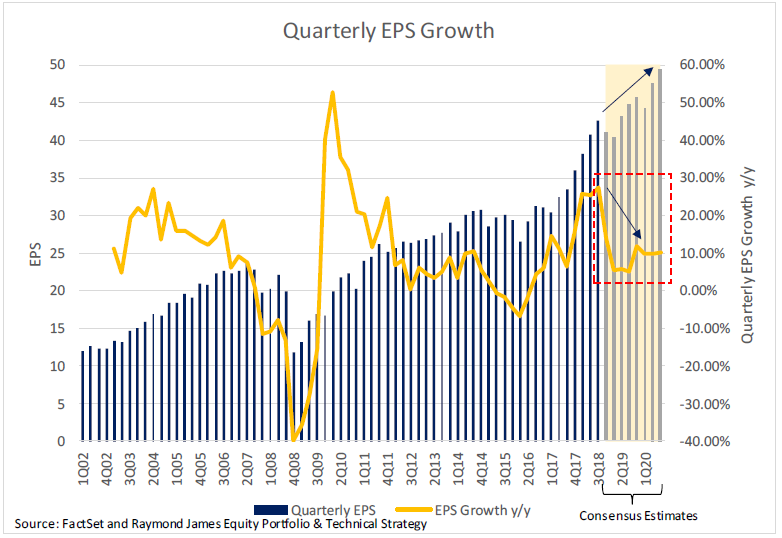

In our 2018 Year End Commentary / 2019 Outlook published earlier this month we noted a handful of dominant factors that we believe negatively impacted Q4 ’18 market returns and will likely continue to be influential in the new year. Among these factors is the concept of “Peak Earnings”. In other words, the fear that earnings can not or will not improve year over year. With 2018 earnings coming in at an astounding 20%+ growth rate buoyed by tax cuts and share buybacks, there is little doubt that 2019 will see a reduced rate of growth in earnings. However, slower growth in earnings (peak earnings growth) should not be confused with an outright decline in earnings (peak earnings). Consensus estimates for 2019 S&P 500 earnings currently sit at about $169, or a growth rate of 6% from 2018. While this rate of growth may seem disappointing compared to the 20%+ 2018 growth rate, it is a reasonable level of growth and should give equity markets the opportunity move higher in 2019.

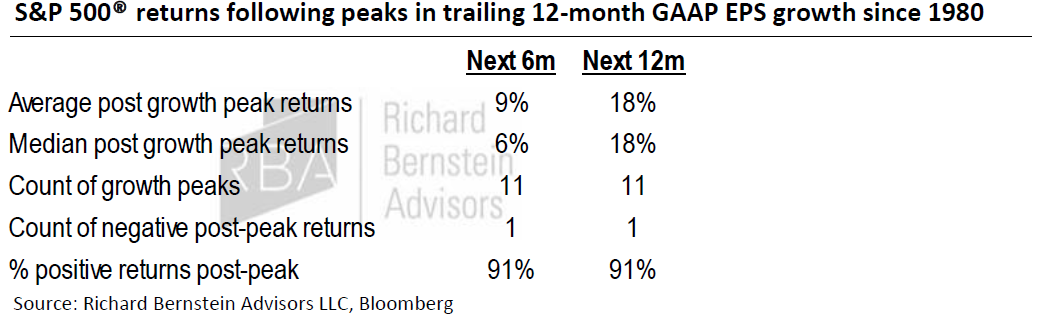

As you can see from the chart above, 2019 will not be the first time we have experienced peak earnings growth. According to Richard Bernstein Advisors, “we have had 11 peaks in profit growth since 1980. In all but one of those instances (91% of the time), returns over returns over the subsequent six and twelve months were positive, with average returns of 9% and 18% respectively. We actually had peaks in earnings growth as recently as 2013 and 2017 and both were followed by periods of very strong returns.”

Assuming consensus estimates are directionally accurate, we will not experience peak earnings in 2019. Of course, estimates can (and will) be revised up or down, and other influencing factors could cause 2019 to be the 2nd occurrence since 1980 to experience negative returns following peak earnings growth. However, the data supports further, albeit slower, earnings growth.

Thanks for taking a look!

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Meagan K. Moll, CFP®, CIMA®, CPWA®

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.